defer capital gains tax australia

31 2026 whichever comes first. Market valuation for tax purposes.

Capital gains withholding - a guide for conveyancers.

. If youre in the top tax bracket and sell a property like this youll be taxed at 20. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Theres no exemption for senior citizens they pay tax on the sale just like everyone else.

Although it is referred to as capital gains tax it is part of your income tax. How to avoid capital gains tax in Australia 1. The deferral is in effect until the QOF investment is sold or exchanged or on Dec.

One year is the dividing line between having to pay short term versus long term capital gains tax. When you sell this asset after holding it for more than a year youll be taxed at the long-term capital gains rate of 15. You must then work out five-tenths of the capital gains tax which is 28125.

Capital gains withholding - for real estate agents. If you made no capital gain in 202021 defer the capital loss until you make a capital gain. Learn about capital gains tax CGT what a CGT event is and ways to reduce your capital gain.

The small business capital gains tax CGT concessions allow you to reduce disregard or defer some or all of a capital gain from an active asset used in a small business. If you want to sell an investment property but dont need to cash out just yet you can defer paying capital gains taxes by doing a like-kind exchange. To get around the capital gains tax you need to live in your primary residence at least two of the five years before you sell it.

In most cases it can be used to reduce a capital gain you made in 202021. Here are some of the main strategies used to avoid paying CGT. As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero.

Sell the Property After 1 Year. CGT does not apply if you owned the asset before CGT started on 20 September 1985. Take Advantage of a Section 1031 Exchange.

Capital gains withholding - Impacts on foreign and Australian residents. Your taxable capital gain may be as low as 50 if you sell to reduce the amount of the selling costs you paid-for instance commissions paid to real estate agents title and legal fees ad costs administrative costs escrow fees or inspection fees. Timing capital gain or loss.

This is the difference between what it cost you and what you get when you sell or dispose of it. Trust non-assessable payments CGT event E4. The objective of the capital gains tax CGT relief provisions is to provide temporary relief from certain capital gains that might arise as a result of complying with the introduction of the transfer balance cap or the transition-to-retirement income stream TRIS reforms.

The 4 small business CGT concessions. Watch this quick 2-minute video to learn how you can defer your capital gains taxes for 30 years with a Tax-Deferred Cash Out. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

The concessions are available when you dispose of an active asset and meet eligibility requirements. There can be a big difference in the rate so it may make sense for some investors to wait at least one year before selling a property. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier.

Including the sale profit of the property is necessary. You mustnt forget that a 50 discount applies because you owned the property for more than 12 months meaning your capital gains tax will be equal to 140625. Transitional CGT relief.

How long do I need to live in a house to avoid capital gains tax Australia. As a trustee of a fund you should ensure. If your business sells an asset such as property you usually make a capital gain or loss.

A 1031 exchange or like-kind exchange lets you defer taxes on the sale of an investment property by using the proceeds to buy another. Long-term capital gains tax is a tax applied to assets held for more than a year. Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250.

Foreign resident capital gains withholding. The QOF then funnels your gains and those of others into federally designated lower-income areas. CGT for specific investment products.

When you sell a house you pay capital gains tax on your profits. Capital gains withholding - for real estate agents. What is the capital gain tax for 2020.

Generally you disregard a capital gain or capital loss on. These myTax 2021 instructions are about capital gains tax events capital gains income and capital losses. CGT is the tax that you pay on any capital gain.

866 959-9969 415 656-8588. Short term capital gains are taxed as ordinary income. The long-term capital gains tax rates are 0 percent 15.

Another outgrowth from the TCJA is the Qualified Opportunity Zone QOZ program which allows you to defer capital gains taxes from your Acme Building stock sale by rolling that profit into a Qualified Opportunity Fund. A house you bought in Australia 20 to 25 years ago will earn you a huge.

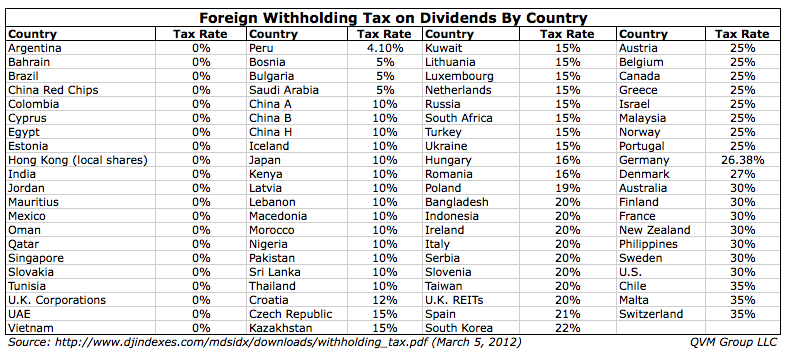

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

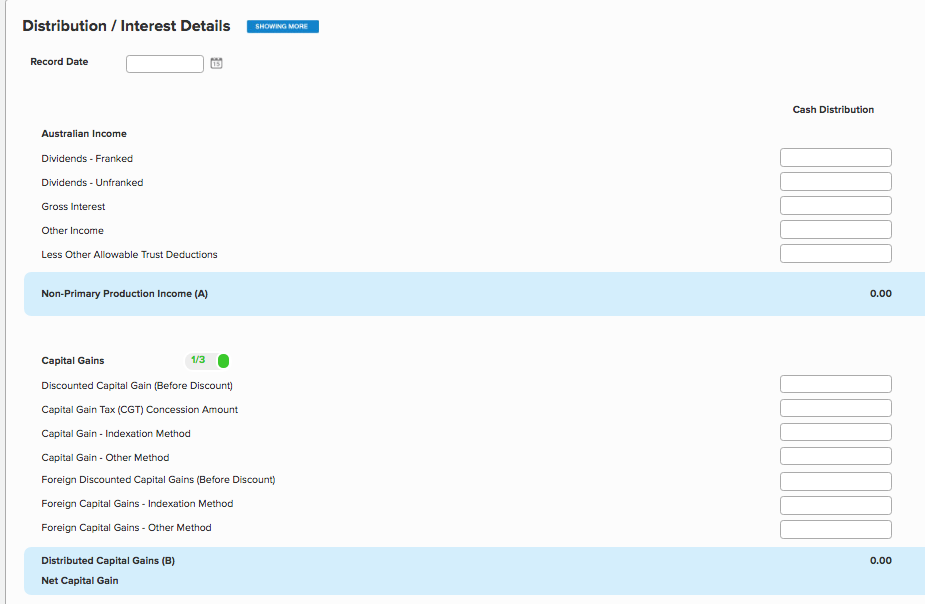

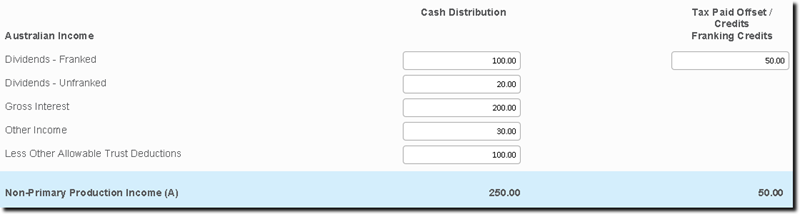

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Managing Capital Gains To Reduce Tax And Boost Your Super

![]()

Is There Capital Gains Tax On My Home Or Business Bishop Collins

Can You Reinvest Capital Gains To Avoid Taxes Oakleigh Accountants

How To Avoid Paying Capital Gains Taxes 100 Legally Wealth Safe

Guide To Crypto Taxes In Australia Updated 2022

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital Gains Tax What Is It When Do You Pay It

Is There Capital Gains Tax On My Home Or Business Bishop Collins

Managing Capital Gains To Reduce Tax And Boost Your Super

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Guide To Crypto Taxes In Australia Updated 2022

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Foreign Companies Expat Tax Professionals

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal